- Page 1

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Flash version

© UniFlip.com

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Flash version

© UniFlip.com

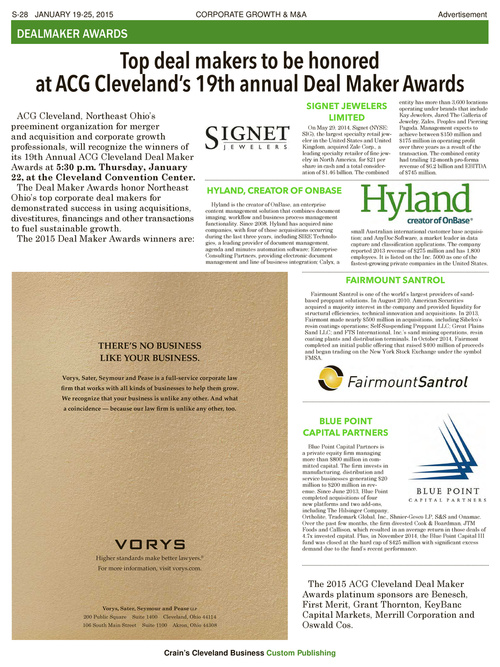

S-28 JANUARY 19-25, 2015

CORPORATE GROWTH & M&A

Advertisement

DEALMAKER AWARDS

Top deal makers to be honored at ACG Cleveland’s 19th annual Deal Maker Awards

ACG Cleveland, Northeast Ohio’s preeminent organization for merger and acquisition and corporate growth professionals, will recognize the winners of its 19th Annual ACG Cleveland Deal Maker Awards at 5:30 p.m. Thursday, January 22, at the Cleveland Convention Center. The Deal Maker Awards honor Northeast Ohio’s top corporate deal makers for demonstrated success in using acquisitions, divestitures, financings and other transactions to fuel sustainable growth. The 2015 Deal Maker Awards winners are: SIGNET JEWELERS LIMITED

On May 29, 2014, Signet (NYSE: SIG), the largest specialty retail jeweler in the United States and United Kingdom, acquired Zale Corp., a leading specialty retailer of fine jewelry in North America, for $21 per share in cash and a total consideration of $1.46 billion. The combined entity has more than 3,600 locations operating under brands that include Kay Jewelers, Jared The Galleria of Jewelry, Zales, Peoples and Piercing Pagoda. Management expects to achieve between $150 million and $175 million in operating profit over three years as a result of the transaction. The combined entity had trailing 12-month pro-forma revenue of $6.2 billion and EBITDA of $745 million.

HYLAND, CREATOR OF ONBASE

Hyland is the creator of OnBase, an enterprise content management solution that combines document imaging, workflow and business process management functionality. Since 2008, Hyland has acquired nine companies, with four of those acquisitions occurring during the last three years, including SIRE Technologies, a leading provider of document management, agenda and minutes automation software; Enterprise Consulting Partners, providing electronic document management and line of business integration; Calyx, a

small Australian international customer base acquisition; and AnyDoc Software, a market leader in data capture and classification applications. The company reported 2013 revenue of $275 million and has 1,800 employees. It is listed on the Inc. 5000 as one of the fastest-growing private companies in the United States.

FAIRMOUNT SANTROL

Fairmount Santrol is one of the world’s largest providers of sandbased proppant solutions. In August 2010, American Securities acquired a majority interest in the company and provided liquidity for structural efficiencies, technical innovation and acquisitions. In 2013, Fairmont made nearly $500 million in acquisitions, including Sibelco’s resin coatings operations; Self-Suspending Proppant LLC; Great Plains Sand LLC; and FTS International, Inc.’s sand mining operations, resin coating plants and distribution terminals. In October 2014, Fairmont completed an initial public offering that raised $400 million of proceeds and began trading on the New York Stock Exchange under the symbol FMSA.

THERE’S NO BUSINESS LIKE YOUR BUSINESS.

Vorys, Sater, Seymour and Pease is a full-service corporate law

BLUE POINT CAPITAL PARTNERS

Blue Point Capital Partners is a private equity firm managing more than $800 million in committed capital. The firm invests in manufacturing, distribution and service businesses generating $20 million to $200 million in revenue. Since June 2013, Blue Point completed acquisitions of four new platforms and two add-ons, including The Hilsinger Company, Ortholite, Trademark Global, Inc., Shnier-Gesco LP, S&S and Onamac. Over the past few months, the firm divested Cook & Boardman, JTM Foods and Callison, which resulted in an average return in those deals of 4.7x invested capital. Plus, in November 2014, the Blue Point Capital III fund was closed at the hard cap of $425 million with significant excess demand due to the fund’s recent performance.

Higher standards make better lawyers.® For more information, visit vorys.com.

Vorys, Sater, Seymour and Pease LLP 200 Public Square Suite 1400 Cleveland, Ohio 44114 Akron, Ohio 44308 106 South Main Street Suite 1100

The 2015 ACG Cleveland Deal Maker Awards platinum sponsors are Benesch, First Merit, Grant Thornton, KeyBanc Capital Markets, Merrill Corporation and Oswald Cos.

Crain’s Cleveland Business Custom Publishing