- Page 1

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Flash version

© UniFlip.com

- Page 2

- Page 3

- Page 4

- Page 5

- Page 6

- Page 7

- Page 8

- Page 9

- Page 10

- Page 11

- Page 12

- Page 13

- Page 14

- Page 15

- Page 16

- Page 17

- Page 18

- Page 19

- Page 20

- Page 21

- Page 22

- Page 23

- Page 24

- Page 25

- Page 26

- Page 27

- Page 28

- Flash version

© UniFlip.com

Advertisement

CORPORATE GROWTH & M&A

JANUARY 19-25, 2015

S-21

M&A TRANSACTIONS

You must have a strong managerial infrastructure. One-man bands get very low valuations unless selling to a strategic buyer. If you are not going with an ibanker (not a great move) then make sure you aren’t pre-empted by a bidder that will drag you through the mud and chop your enterprise value. Know key growth benchmarks in your industry — percentage of EBITDA to revenue — so you know how your company compares. Have your ibanker check the bidders for “retraders,” provide a draft of the purchase agreement and find out which bidders historically overleverage a business. If you remain a manager/owner post-close that will have a big impact on how you run the business.

2 3

If you roll over equity, remember you don’t get to put it back into the company if you are no longer with the business. Make sure the buyer knows your industry, is spending significant diligence money and that you are more or less guaranteed “certainty of close.” Deals take longer to close since prices are higher, thus making risks higher. And, now we are seeing lenders bring in their own diligence teams on regulated industries. It has become a very fast and arduous track.

6

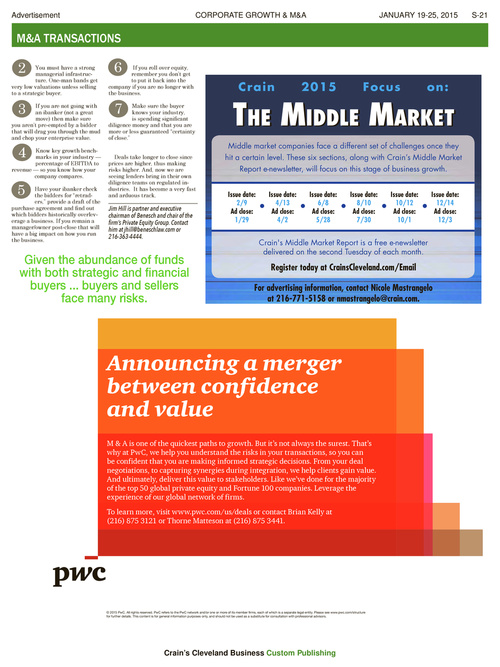

Crain

20 1 5

F oc u s

on:

7

THE MIDDLE MARKET

Middle market companies face a different set of challenges once they hit a certain level. These six sections, along with Crain’s Middle Market Report e-newsletter, will focus on this stage of business growth.

Issue date: 2/9 Ad close: 1/29 Issue date: 4/13 Ad close: 4/2 Issue date: 6/8 Ad close: 5/28 Issue date: 8/10 Ad close: 7/30 Issue date: 10/12 Ad close: 10/1 Issue date: 12/14 Ad close: 12/3

4

5

Jim Hill is partner and executive chairman of Benesch and chair of the firm’s Private Equity Group. Contact him at jhill@beneschlaw.com or 216-363-4444.

Given the abundance of funds with both strategic and financial buyers ... buyers and sellers face many risks.

Crain's Middle Market Report is a free e-newsletter delivered on the second Tuesday of each month.

Register today at CrainsCleveland.com/Email For advertising information, contact Nicole Mastrangelo at 216-771-5158 or nmastrangelo@crain.com.

© 2015 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

Crain’s Cleveland Business Custom Publishing